If you wish to contribute or participate in the discussions about articles you are invited to contact the Editor

GNSS Market Report: Difference between revisions

m (corrected typo.) |

Paulo.Pombal (talk | contribs) |

||

| Line 124: | Line 124: | ||

*[http://www.gsa.europa.eu/sites/default/files/GSAGNSSMarketreport2010.pdf GNSS Market Report Issue 1, 2010] | *[http://www.gsa.europa.eu/sites/default/files/GSAGNSSMarketreport2010.pdf GNSS Market Report Issue 1, 2010] | ||

*[http://www.gsa.europa.eu/sites/default/files/MarketReportMEP72012WEB.PDF GNSS Market Report Issue 2, 2012] | *[http://www.gsa.europa.eu/sites/default/files/MarketReportMEP72012WEB.PDF GNSS Market Report Issue 2, 2012] | ||

*[http://www.gsa.europa.eu/system/files/reports/GSA%20-Market%20Report%202013%20new_1.pdf GNSS Market Report Issue 3, October 2013] | |||

*[http://www.gsa.europa.eu/system/files/reports/GNSS-Market-Report-2015-issue4_0.pdf GNSS Market Report Issue 4, March 2015] | |||

==References== | ==References== | ||

Revision as of 14:45, 1 June 2015

| Applications | |

|---|---|

| Title | GNSS Market Report |

| Edited by | GMV |

| Level | Intermediate |

| Year of Publication | 2014 |

The European GNSS Agency (GSA) has been publishing with some regularity the GNSS Market Report on future trends for the Global Navigation Satellite System (GNSS) market[1]. The GSA report is already key references for companies and organisations to build their market strategies in relation to GNSS.

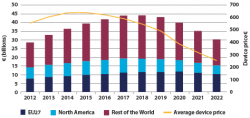

The underlying market model utilises advanced forecasting techniques applied to a comprehensive range of input data, assumptions and scenarios to forecast the size of the GNSS market in the European Union, North America and Rest of the World. Assumptions are informed by expert opinions and model results are cross-checked against the most recent market research reports from independent sources, before being validated through an iterative consultation process with sector experts and stakeholders.[2]

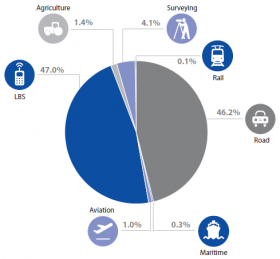

The last report was published on October 2013 and presents forecasts on specific GNSS market segments: Location-based services (LBS), Road, Aviation, Rail, Maritime, Agriculture, Surveying. The report can be found in the GSA website.

Report Overview

In this article are presented the most relevant forecast comments and some report figures wherein the considered terminology refers to:

- Shipments: the number of devices sold in a given year;

- Installed base: the number of devices currently in use;

- Revenue: the revenue from device/service sales in a given year.

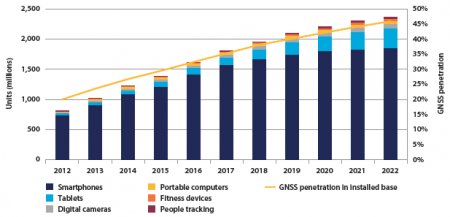

The most outstanding forecast is that the actual global installed base of GNSS devices of about two billion units is predicted to grow almost four-fold over the coming decade to seven billion – almost one GNSS receiver for every person on the planet by 2022. However the use of communications and other positioning technologies alongside GNSS, and the emergence of new constellations requires constant innovation on the supply side.

LBS is forecasted to be the largest market segment by revenue, overtaking Road, where the Personal Navigation Devices (PND) market continues to decline, being cannibalised by the use of smartphones in cars. LBS devices are also being increasingly used in general aviation and leisure maritime. This is due to the competitive pricing that made smartphones more affordable leading to a rapidly increase of their market share compared to traditional mobile phones without GNSS capability.

Multi-constellation devices are becoming more common in the market, offering increased availability (appreciated especially in urban environments) and more robust performance in professional applications (e.g. in Surveying). In such devices Galileo is recognised as a valuable element, and it is already present in more than 30% of receiver models, despite the time that remains for the establishment of its operational capability. However the BeiDou System is also being used in about 20% of the multi-constellation devices, particulary by those that are built by manufacturers based in Asia-Pacific.

Location-based services (LBS)

Smartphones comprise 90% of LBS devices sold in 2012. However, with the growing penetration of tablets and increased GNSS usage in digital cameras, the smartphone share will decrease over the next decade. There has been a substantial increase in the number of forecast smartphone shipments since the last issue of the market report. This is driven by the falling price of smartphones relative to users incomes.

The most important GNSS characteristics for the LBS market are Time-To-First-Fix (TTFF) and availability due the increasingly fast pace of life that lead the users to want to get to their destinations more quickly. Use of assisted GNSS lowers TTFF by transferring part of the data used to determine the position over mobile networks. Several test results show that availability is significantly improved (especially in urban canyons) by the existence of additional satellite constellations. This means that emerging GNSS Systems such as Galileo and BeiDou will improve the performance of LBS services.

Road

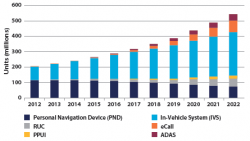

Increased regulatory pressure for emergency location sharing and safety-related applications drives the demand for telematics equipment, which serves as a platform for innovative applications. As an example, EU policy has made DTs mandatory for vehicles with a mass of more than 3.5 tonnes in goods transport and those carrying more than 9 persons in passenger transport, and all new types of passenger cars and light vehicles will need to have an eCall system from 2015.

Dedicated nomadic GNSS devices (PNDs) are becoming redundant with increasing use of smartphones and better affordability of In-Vehicle Systems (IVS). In fact with smartphone navigation becoming increasingly popular, the PND market has been declining since 2009. Even so, the installed base of GNSS devices quadrupled from 2006 to 2012, reaching over 200 million devices. This is due mainly to the significant decrease of average device prices and also because GNSS-based Intelligent Transport Systems (ITS) became more common in vehicles.

Competition in the automotive industry and from smartphones, combined with declining prices in consumer electronics in general, will result in price erosion for both PND and IVS.

Traffic information services enabled by GNSS are forecast to be the primary driver of growth in service revenues until 2018. Thereafter, fierce competition in this segment will result in total revenues declining to around 2012 levels by 2022. The appearance of the first GNSS-based Road User Charging (RUC) schemes resulted in the uptake of dedicated OBUs with the market share increasing from almost zero in 2009 to more than 2% of all road devices sold in 2012.

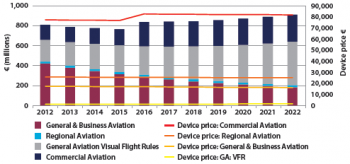

Aviation

GNSS use in Aviation will increase as more flight procedures are designed to take advantage of Performance Based Navigation (PBN). For example, EGNOS-enabled instrument approach procedures to Localizer Performance with Vertical guidance (LPV) minima are being rolled out in Europe, increasing safety and business continuity at aerodromes.

New GNSS constellations are expected to be available in the next few years providing multifrequency and multi-constellation navigation capabilities, which may improve the performance of existing PBN applications. This is expected to be a key enabler for Ground Based Augmentation Systems (GBAS), resulting in lower minima to CAT II or CAT III standards, demanded by some commercial operators.

The use of GNSS within all aviation segments is expected to increase over the next decade reaching a penetration of over 90% in 2022. This increase will be dominated by the Visual Flight Rules (VFR) sub-segment, with leisure flyers using GNSS as a supplementary information source. The installed base of GNSS devices is expected to increase gradually, driven by the non-certified devices used in the general aviation VFR sub-segment. The stock of devices in general & business aviation stabilises, dominated by forward fit. Commercial and regional aviation continue to increase their share of the market.

Commercial aviation GNSS shipments are predicted to increase as GNSS capabilities are deployed in response to regulatory changes, and the need for commercial operators to support routes to an increasing number of destinations. As a result, commercial aviation GNSS manufacturers are expected to capture approximately 30% of the Aviation market revenue by 2022.

The use of Instrument Flight Rules (IFR) devices is expected to increase, driven by PBN implementation. Despite increasing GNSS shipments, revenue growth will slow down as the market becomes dominated by forward-fit aircraft (which have a lower cost). The increase of the average price of commercial aviation devices in 2016 is due to anticipated retrofits of SBAS capability.

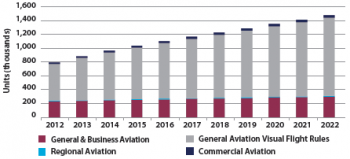

Rail

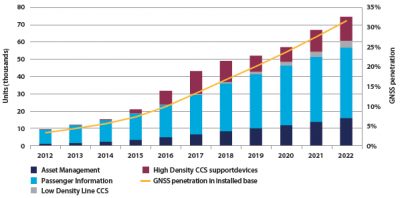

Over the coming decade, GNSS use in Rail is expected to increase substantially since is becoming a standard feature in non-safety applications.

Europe, which has a very well developed passenger train network, has historically been the main market for GNSS devices, as sales have been dominated by passenger information systems. However, as many regions invest heavily in rail infrastructure, particularly in China, the Rest of the World market has grown to become highly significant, representing roughly 40% of GNSS shipments in 2012.

Compared to other industries, the railways have been slow to adopt GNSS technology. This is in part due to the perceived challenges of using space technology on the railways and safety considerations, such as the presence of tunnels, covered stations, deep cuttings, etc. where the signal is not available. Because of that the GNSS penetration in installed base by 2022 is expected to be only about 30%.

The main current use of GNSS in Rail is in passenger information systems, however other non-safety critical applications, such as asset management, are becoming significant, with sales of approximately 1,000 devices in 2012. By 2022 it is expected that this number will grow to 15,000.

It is forecast that 30% of trains in use worldwide will be equipped with GNSS for some purpose by 2022. Most devices are likely to be non-safety critical in the short to medium term, however, GNSS devices will increasingly support safety critical functions.

The regulatory requirements for Positive Train Control (PTC) in the USA drive the sales of high density train control devices between 2015 and 2019. The roll-out programme was originally intended to be completed for Class-1 railroads by 2015, though there have been some delays to this timescale.

European roll-out of ETCS Level 3 is expected to occur gradually towards the end of the decade. Low density line Command & Control Systems (CCS), offering significant cost savings by removing large parts of the trackside infrastructure, is expected to see cautious introduction, particularly on passenger lines.

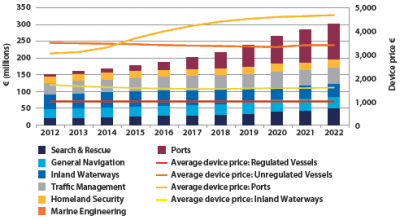

Maritime

Maritime general navigation was an early adopter of GNSS and remains an extensive user. Is also segment in expansion being the main evolutions related with the following aspects:

- Multi-constellation GNSS receivers at the centre of the proposed International Maritime Organisation (IMO) e-navigation concept;

- COSPAS-SARSAT enhancing the infrastructure with GNSS to reduce reaction time in emergency response.

Many of the regulated applications of GNSS in the Maritime segment already have high, if not total, GNSS penetration. For these applications, equipment replacement and new vessel construction are the drivers for equipment sales, as systems reach the end of their lifecycle or become outdated or obsolete. With over 50,000 regulated vessels globally and large ships using several receivers, this represents a very established, yet stable market.

Sales of devices are forecast to be led by GNSS-equipped SAR beacons for which a number of devices may be installed on each vessel (e.g. on lifeboats). In addition, the lifecycle of a SAR beacon tends to be shorter than for a standard navigation receiver. Second-generation SAR beacons, which are foreseen to have the return link feature, are likely to further stimulate the market in the next decade. The regulatory requirements for such beacons are currently being developed by COSPAS-SARSAT.

The use of GNSS in ports is forecast to grow rapidly due to the increasing congestion of the waters in and around ports, combined with the ever increasing size of vessels. Ports are set to grow into the largest application by revenue by 2022.

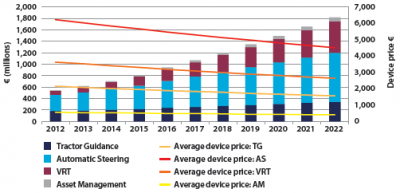

Agriculture

Between 2006 and 2012, global shipments and the installed base of GNSS devices in the agriculture segment more than tripled.

North America, representing the highest share in shipments and installed base, is the most technologically advanced region with respect to precision agriculture. Major crop productions are related to corn, soybeans and wheat which are ideal for GNSS-based applications. The Rest of the World comprises countries with markedly different levels of technological development, varying from Japan and Australia, with extensive adoption of precision agriculture, to nascent markets such as China and India. In Europe, growth in shipments and installed base is the result of GNSS adoption in Western European countries where more favourable conditions exist, such as larger average farm size and greater access to capital.

Technological progress and consolidation of farms are the key drivers for growth in shipments of GNSS devices in all regions. Farmers in developed countries will opt for more advanced solutions (e.g. Automatic steering and VRT) to further increase productivity. On the other hand, developing countries will modernise their means of agricultural production in order to face the major challenges of rising input costs, resource scarcity, and food demand.

Revenues will be generated mainly by automatic steering and VRT, growing much faster than previously estimated. Together, these two applications will provide nearly 80% of revenues in 2022.

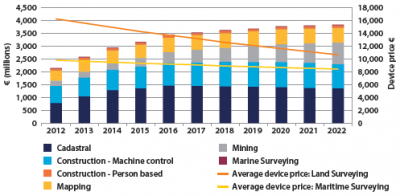

Surveying

Major growth in surveying depends heavily on economic conditions in high growth economies. Cadastral and construction segments are the largest applications of GNSS in surveying. New professional users in environmental and engineering disciplines together with mapping communities are fostering the use of geoinformation and the development of new applications.

Surveying segment is an early adopter of new location technologies such as GNSS. Currently, professional surveying receivers are already using all available GNSS signals (multi-constellation and multifrequency) and other differential correction techniques (e.g. SBAS, RTK, DGPS). The role of GNSS receivers in the surveying equipment market has demonstrated the added value of satellite positioning to optimise survey operations and fruitful co-existence with other land measurement technologies, such as laser scanners and photogrammetric/LIDAR cameras.

The surveying market in the Rest of the World is expected to experience major growth and develop much faster than in Europe or North America. This is due to a high level of construction activity in those regions. In addition, GNSS is expanding faster in the Rest of the World region because often there are no alternative legacy systems and dense geodetic ground networks to support surveys frequently do not exist. Surveying equipment is still expensive compared to other segments, however price erosion can be observed in the last few years supported by increased competition and demand, and lower production costs.

Due to increasing Gross Domestic Product (GDP) and population in the Rest of the World, cadastral surveys will increase in importance and frequency. In growing economies, land boundaries and their measurement are likely to become a far more important issue due to the regulations associated with the ownership of property. Cadastral surveys are also important for restoration work after natural disasters.

Previous Report Issues

The previous GNSS Market Reports can be found in the GSA Site:

- GNSS Market Report Issue 1, 2010

- GNSS Market Report Issue 2, 2012

- GNSS Market Report Issue 3, October 2013

- GNSS Market Report Issue 4, March 2015

References

- ^ GNSS Market Report, European GNSS Agency (GSA)

- ^ GSA Market Report Promises Success For GNSS, European GNSS Agency (GSA), October, 2013